Blog

Selling Your Business to an Employee

Cover all the bases! Business Valuation: Accurately valuing the business is crucial for setting a fair sale price. A thorough assessment of the business's financials, assets, market position, and growth potential will help determine its worth. Terms of Sale: The terms...

Seller Financing – What You Need to Know

Selling a business is a complex dance that requires not just a transfer of assets but also a transfer of knowledge and trust. For owners with decades of experience, the challenge lies in ensuring the new steward of the business is not only capable but also committed...

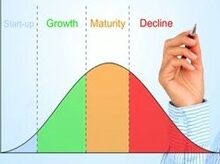

Life Cycle of Your Business and the Value Perspective

As a Certified Valuation Analyst with the National Association of Certified Valuators and Analysts, it's imperative to comprehend the nuanced trajectory of businesses through their lifecycle stages: startup, growth, maturity, and decline. Each phase presents unique...

Selling a business is a significant undertaking, often requiring sellers to present their financials in the best possible light. One crucial aspect of this process is the identification and verification of addbacks and taxable losses. However, in the complex world of business sales, my mantra “If in doubt, leave it out” becomes a guiding principle. Here is my advice when preparing financial statements and the wisdom of erring on the side of caution.

Understanding Add Backs and Taxable Losses: 1. Addbacks: Addbacks are adjustments made to a business's financial statements to reflect the true earning potential of the company. These adjustments typically involve discretionary expenses, one-time costs, or owner...

Navigating the Final Lap: A Complete Guide to Closing a Business Sale

The process of closing a business sale involves a series of crucial steps and legal documents to ensure a smooth and legally binding transaction. From the initial negotiation to the final signatures on the dotted line, each step plays a pivotal role in bringing the...

Business Valuation 101

If someone is going to buy your business – how will you determine a sale price and justify the sale price to the buyer? When it comes to determining the value of a business, appraisers employ various methods, each designed to provide a different perspective on a...

Navigating the Sale of Your Privately Owned Business: From Easiest to Most Challenging

Introduction: Selling a privately owned business is a significant decision that requires careful consideration of various factors. Whether you're ready to retire, pursue new opportunities, or simply move on from your current venture, understanding the different...

9 Secrets of Finding Buyers

Connecting sellers with the right buyers is a pivotal task. I believe 50% of my time is finding buyers while the remaining 50% is working through the deal to closing. Whether it's a first-time buyer eager to embark on an entrepreneurial journey, a seasoned serial...

Unlocking Success: What are the key differences between accomplished Business Sellers and Aspiring Business Dreamers?

Here are the traits, strategies, and experiences that set apart those who successfully sell their businesses from those who merely dream of doing so. Will 2024 be the year you make the successful business exit? Successful Sellers: Expert Guidance: Successful business...

14 Red Flags of a BAD BUSINESS Buy

Much discussion and most articles about business selling revolve around the key ingredients of a good listing. The flip sides of course are the obvious red flags or warning signs that the listing might be bad and at best a marginal listing. My company does buyer...